Industry:

Industrials

Headquarters:

Carol Stream, IL

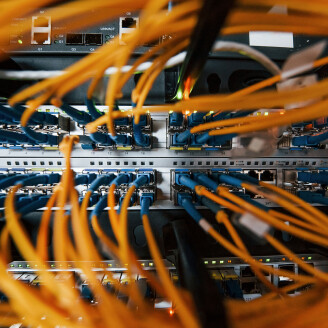

Communications Supply Corporation is a national distributor of low voltage infrastructure products in the United States.